2024 Reflections: Predictions vs. Reality in the Foodservice Industry

As we reflect on 2024, it’s evident that the foodservice industry’s transformation has continued to redefine the way operators and suppliers navigate challenges and capitalize on opportunities. This year demanded bold strategies, visionary thinking, and an unrelenting focus on collaboration. By adapting to the insatiable consumer, prioritizing profitability, leveraging technology, and addressing supply chain volatility, the industry has proven that resilience and creativity are key to staying ahead.

Using Kinetic12’s

eight key predictions for 2024, we reflect not only on what has happened but extract actionable insights to inform the path forward.

1. The Insatiable Consumer

Prediction: Consumers in 2024 were expected to crave unparalleled experiences, demanding exceptional service and uncompromising quality while showing little patience for mistakes.

Reality: The industry faced heightened consumer expectations as predicted. Operators learned that focusing on menu consistency and guest experience were pivotal to driving traffic, with 71% identifying these as their most successful tactics. Loyalty programs were not merely "nice to have" but essential in retaining customers amid tightening discretionary spending (Emergence Report Q3 2024; Q4 2024).

Key Learning: Consumers now define value as an experience – not just price. Operators who prioritize creating memorable moments, personalizing offers, and exceeding expectations will lead the pack. Suppliers must support by enabling experiential differentiation through innovation and tailored solutions.

2. The Prioritization of Operator Profit

Prediction: Operators were expected to make profitability their number-one focus, relying on cost control, operational efficiency, and tech adoption to offset rising costs.

Reality: As inflation persisted, operators were forced to push beyond traditional methods. Many uncovered hidden profit opportunities by simplifying operations and collaborating with suppliers on pricing strategies. Technology played a critical role, especially in labor optimization and waste reduction. Suppliers who helped operators manage costs through creative solutions solidified long-term partnerships (Emergence Report Q2 2024; Q4 2024).

Key Learning: Profitability doesn’t just happen – it requires proactive planning. Operators should embrace a mindset of continual improvement, from simplifying menus to rethinking workflows. Suppliers that offer innovative, margin-friendly solutions become invaluable allies.

3. The Chain Landscape Redefined

Prediction: Mergers, acquisitions, and regional chain growth would reshape the competitive landscape, with smaller brands leveraging their agility to scale.

Reality: There has been a reset in foodservice being led by the larger chains. Bankruptcies have reset a number of businesses, and consolidations have persisted, but not all change has come from M&A, and in a surprising turn, many changes have been led more by the larger chains vs. the smaller emerging ones, including a refocus on value and investment in new revenue streams.

Key Learning: Regional chains and smaller brands, while more nimble, may lack some of the resources available at the larger chains. Still, there is an opportunity for them to remain laser-focused on operational excellence and adaptability, while fast-tracking change to keep competitive with the larger competitors. Suppliers should align with these growth-oriented operators and tailor their approach by offering scalable solutions and emphasizing speed-to-market support

"Agility isn’t just a buzzword – it’s a survival tool."

4. The Off-Premise Revolution

Prediction: Off-premise dining was expected to evolve, with investments in technology, packaging, and redesigned spaces driving growth.

Reality: Off-premise operations became a key revenue driver for many brands, with 68% of operators redesigning store layouts to optimize production for delivery and takeout. Advances in digital ordering platforms and innovative packaging elevated the off-premise experience. These changes also aligned with consumer demand for convenience without sacrificing quality (Emergence Report Q3 2024; Q4 2024).

Key Learning: Off-premise is no longer a "channel" –it’s an extension of the brand. Operators must seamlessly integrate off-premise experiences into their core strategy, ensuring that food quality, speed, and branding are uncompromised. Suppliers can enhance their value by offering turnkey packaging solutions and operational innovations

5. The New Labor-Management Mindset

Prediction: Labor retention and engagement would remain critical, with an emphasis on creating enjoyable workplaces and building career paths.

Reality: Labor challenges were pervasive, but operators who invested in employee engagement and flexible work environments reaped significant rewards. Improved morale directly contributed to consistent execution and better customer experiences. By Q2, recognition, fair compensation, and training emerged as the top drivers of workforce satisfaction (Emergence Report Q2 2024; Q3 2024).

Key Learning:

Happy employees create happy customers. Operators must shift from viewing labor as a cost to treating it as an investment. Suppliers can play a role by simplifying operations and providing labor-saving solutions that ease back-of-house challenges.

6. The Instability of the Global Supply Chain

Prediction: Ongoing disruptions in the supply chain would force operators and suppliers to adopt more proactive, flexible strategies.

Reality: Supply chain unpredictability, from raw material shortages to transportation delays, required constant adjustments. Though we expected some instability, the uncertainty and severity of the issues showed things shifting in ways that were unexpected. With the new political administration, talks of tariffs impacting the global supply chain and costs have added a layer of additional strain on already tight margins, and with the Baltimore port shutdowns in global imports, we learned that even the smallest of blips can have catastrophic consequences if not addressed promptly and swiftly.

70% of operators emphasized the value of suppliers who were proactive and transparent in addressing challenges

(Emergence Report Q3 2024; Q4 2024)

Key Learning: We may see a shift to more domestically sourced goods and a re-emphasis on contingency planning to hedge off global supply chain instability and control costs. Supply chain resilience is a team sport, and operators must prioritize partnerships with suppliers who are proactive, transparent, and solutions-oriented to better prepare for the future.

7. The Evolution of the Distributor Business Model

Prediction: Distributors would invest heavily in technology, automation, and data to streamline operations and enhance customer engagement.

Reality: Distributors made significant strides in digitization, leveraging data analytics to improve forecasting and inventory management. However, though technology investments have improved transparency and information availability, the full customer value and the benefit of the improved experience has just begun to be fully realized by the operator.

Key Learning: Technology is transforming the distributor-operator relationship. With more orders happening online, the importance and role of the DSR is changing from the tactical approach of the past to operators wanting more of a consulting partner. As distributors continue to invest in technology, they must not lose sight of the customer impact, and will need to look at harnessing data to provide actionable insights and improve service levels for operators, to remain indispensable partners.

8. The Manufacturer’s Hunt for Growth

Prediction: Manufacturers would look beyond traditional markets, leveraging data and innovation to uncover new growth opportunities.

Reality: Manufacturers increasingly used data-driven insights to expand their offerings, targeting nontraditional channels like convenience stores and prepared foods, and leveraged data analytics to determine new opportunities for growth within existing or new customers. Operators also appreciated manufacturers who actively identified and delivered tailored growth solutions (Emergence Report Q3 2024; Q4 2024).

Key Learning: Growth opportunities are everywhere – but only for those willing to look beyond the status quo. Manufacturers must combine data insights with a willingness to look beyond traditional customers, markets and segments.

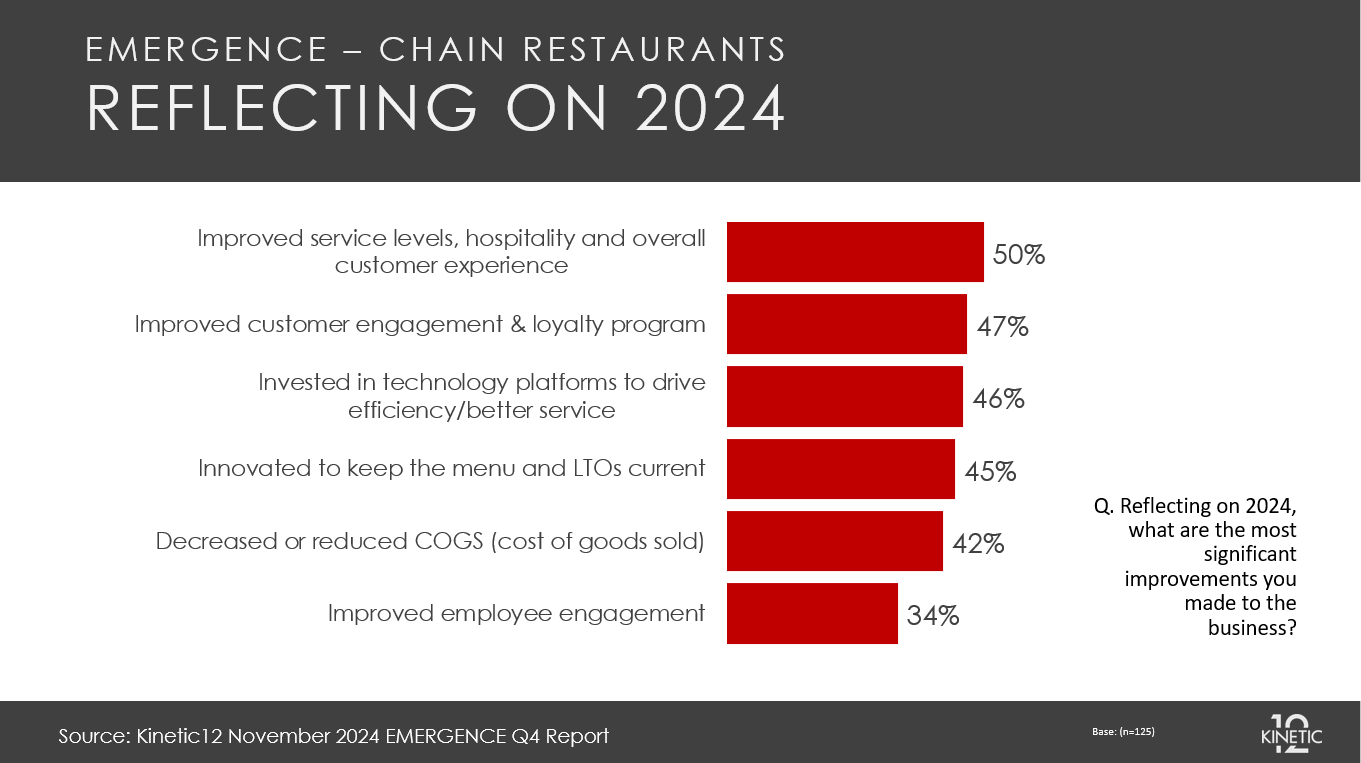

Operator Reflections:

Looking back at the progress we’ve made over the past year, operators have seen the most improvement in addressing service levels, hospitality, and customer service, as well as customer engagement, efficiency, and menu innovation. So, while traffic and profitability still remain critical issues, the things we’ve been doing have made a sizable impact on improving the base business to build a more sustainable future.

Conclusion: The Resilient Path Forward in Foodservice

As we close out 2024, it’s clear that the industry has proven its resilience by navigating a year of significant challenges with a sharp focus on collaboration, innovation, and adaptability. From the outset, operators and suppliers alike committed to tackling the toughest issues: rebuilding guest traffic, optimizing profitability, simplifying operations, and redefining the customer experience.

Each quarter presented new tests but also affirmed the industry’s creativity and dedication to growth. The drive to retain loyal customers and offer consistent quality amid rising costs underscored the need for agility, while technology emerged as an indispensable tool, transforming both front- and back-of-house experiences. Likewise, operators’ focus on employee engagement led to a richer, more reliable service that resonated with customers and strengthened brand loyalty.

The results speak for themselves: suppliers who stepped up as true partners, offering stability and innovative solutions, earned loyalty, while operators who invested in streamlined, yet distinct, offerings carved out competitive advantages even in a crowded market. Together, these efforts have shaped a robust framework that will continue to deliver value in the "Next Normal."

2024 reminds us that success in foodservice is not only about responding to immediate challenges but about forging a forward-looking path where innovation, partnership, and consistency build a foundation for lasting impact. As we move beyond this year, the lessons learned will undoubtedly fuel the industry’s ability to rise above challenges, fostering growth, resilience, and a renewed commitment to exceptional service.

About Kinetic12: Kim Letizia, Tim Hand, Art Bell, and Bruce Reinstein are with Kinetic12 Consulting, a Chicago-based Foodservice and general management consulting firm. The firm works with leading Foodservice suppliers, operators, and organizations on customized strategic initiatives, as well as guiding multiple collaborative forums and best practice projects. They also engage as keynote speakers at operator franchise conferences and supplier sales meetings. Their previous leadership roles in restaurant chain operations and at Foodservice manufacturers provide a balanced industry perspective.

Contact us to learn more about how we can help your organization through customized consulting or through participating in our Emerging & Growth Chains program.